Interact Analysis has been covering the motor and drive space since its inception. Within the AC motor and drive market, low voltage is commonly understood as being less than 690V. During last year’s edition of our annual low voltage AC motor drive market research, we noticed a common term being mentioned – “Ultra Low Voltage”. This was the first time we had heard this used in the context of traditional motor and drive markets and it immediately piqued our interest.

Upon further exploration, we found the term Ultra Low Voltage to mean less than 60V and determined the strength of the trend was significant enough to warrant producing a dedicated report on the topic. In April, we published our first edition of a market report titled Ultra Low Voltage Drives – 2023 which explores the drivers behind the shift towards <60V architectures and where they are gaining the most traction.

Why <60V?

From a product safety perspective, there are advantages to using <60V systems over their higher voltage counterparts. Within industrial applications, the UL product safety standard mandates that products with an input voltage of greater than 60V have additional protective features to mitigate the risk of shock to those encountering the device. As a result, using a <60V system where applicable allows for easier maintenance. Since the system is within a ‘safe’ voltage range, it can be maintained by a less skilled technician without risk of electrocution – something that carries a premium in today’s manufacturing landscape.

The emerging skills gap within the field of manufacturing technicians has been commonly cited as a driver for many trends within the industrial automation sector. As older, more experienced technicians exit the workforce, fewer younger engineers are entering as replacements.

Manufacturers are therefore struggling to find labor skilled enough to efficiently perform the necessary maintenance on crucial equipment. For example, predictive maintenance and condition monitoring technology have seen a rapid increase in adoption as a mechanism to reduce this skills gap. The adoption of safer <60V architectures can be viewed through a similar lens.

Increasing Prevalence of Battery Driven Processes Across Manufacturing and Logistics

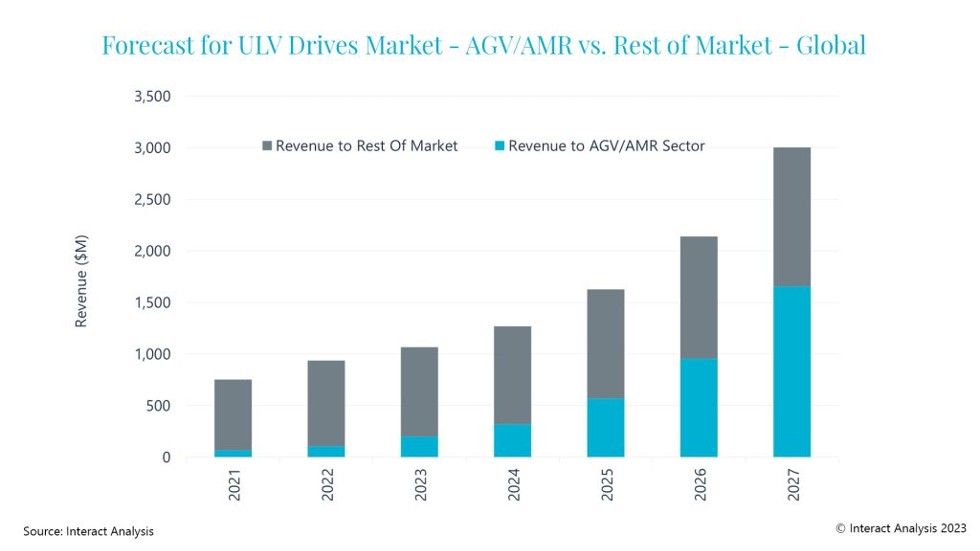

The second major driver towards <60V architectures stems from the increasing prevalence of battery driven applications within industry. Automated guided vehicles (AGVs) and autonomous mobile robots (AMRs), most notably, have seen sales increase significantly in recent years and the market for these vehicles is anticipated to continue to grow at a steep rate. The majority of these vehicles operate with a 24V or 48V battery. Consequently, the motors and drives used fall within the ultra-low voltage threshold.

Over the next five years, ultra-low voltage drives sold to the AGV and AMRs sector are forecast to see a CAGR of 71%, making it the fastest growing sector covered within our report. By 2027, we expect the sale of ultra-low voltage drives to AGV/AMR applications to comprise approximately 55% of total market revenues.

Growth in Automation of Auxiliary Systems Within Machinery

The next significant driver of growth for the ultra-low voltage motor and drives market is a bit more nuanced. Within machinery, particularly machinery with an abundance of small actuation points, there is an increased level of automation being employed in historically manual processes. A prominent example can be found within packaging machinery. As packaging machines are designed to accommodate multiple products, packaging materials, etc. the machine has to become more flexible.

Historically, materials or systems had to be adjusted manually, whereas machine builders are now pushing more automation into these auxiliary systems to enable more efficient processes. Ultra-low voltage brushless DC and stepper motors are often selected to carry out these automated processes due to their high level of control, ease of maintenance and low cost. As a result, ultra-low voltage drive usage is increasing within these types of systems.

Final Thoughts

As market analysts, we often see trends in our areas of coverage influencing other sectors. Interact Analysis has covered general-purpose motor and motion control markets for some time. The ultra-low voltage trend was brought up unprompted in several interviews with suppliers operating in both markets. This often indicates significant growth for the trend in question as it has begun to influence sales of related products.

We produced research into this market under the hypothesis that we would find significant growth. After speaking with suppliers of the products and finalizing the research, we can consider our hypothesis confirmed.

For more information on our Ultra Low Voltage Motor Drives report, download our brochure here.

![Forecasts, Opportunities, and Challenges for the Polish Industry in 2024 [ANALYSIS] Forecasts, Opportunities, and Challenges for the Polish Industry in 2024 [ANALYSIS]](https://industryinsider.eu/wp-content/uploads/xIndustry-40-320x167.jpg.pagespeed.ic.o8zijDQlIJ.jpg)

![The importance of artificial intelligence in transport and automotive industry is growing [REPORT] The importance of artificial intelligence in transport and automotive industry is growing [REPORT]](https://industryinsider.eu/wp-content/uploads/xcity-320x167.jpeg.pagespeed.ic.xFkQdk7qXO.jpg)

![By 2030, the market size of metal processing tools is expected to reach $120.44 billion [REPORT] By 2030, the market size of metal processing tools is expected to reach $120.44 billion [REPORT]](https://industryinsider.eu/wp-content/uploads/xcutting-tools-320x167.jpg.pagespeed.ic.SgnEk-RWA-.jpg)