- Overall cobot sales hit record high in 2021 at 31,325 units

- Cobot market to exceed $2 billion by 2026

- Logistics and service industries will be the long-term market drivers

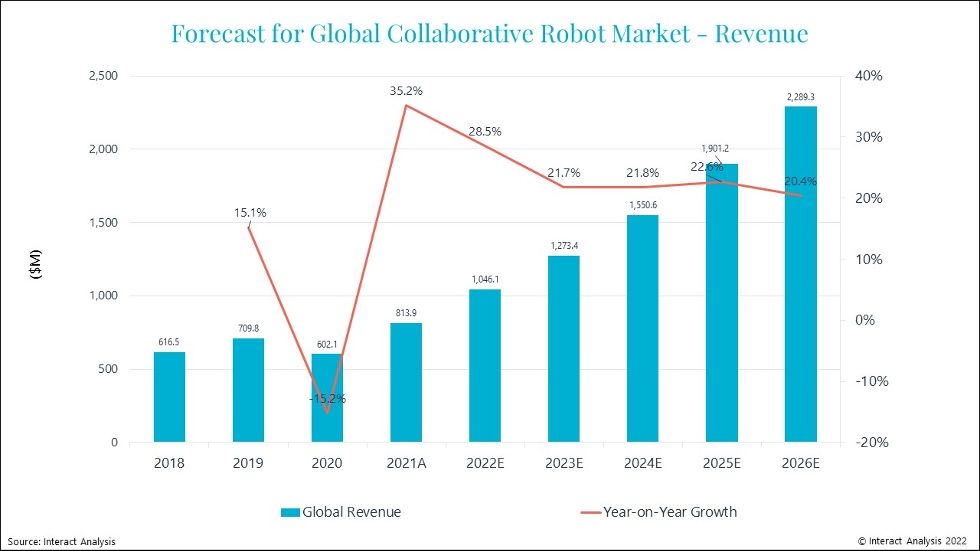

Updated cobot research from Interact Analysis shows that the market enjoyed 45% growth in 2021 as part of a post-pandemic rebound. The market for collaborative robots will continue to grow strongly out to 2026 with annual growth rates sitting at just over 20%. Logistics and service industries are likely to be the long-term growth drivers.

The Chinese market for collaborative robots continues to lead over the EMEA and Americas regions. Interact Analysis predicts that China’s market share by shipments will increase from 49.1% in 2021 to a staggering 54.4% in 2026 (at which point annual unit shipments will exceed 50,000). The research shows that China’s 2022-2026 cobot CAGR will be 29% – the highest of all the global regions. The Americas – where uptake of cobots particularly in manufacturing is much more cautious – are likely to retain the smallest market share overall with a still impressive 5-year CAGR of 19.4%.

By 2026 the collaborative robot market will be three times the size it was in 2021, exceeding $2bn that year and with shipment rates hitting the roof at 100,000 units. The outlook is positive for the long-term, with the research showing that growth rates of 20% will be maintained right out to 2030.

A key focus for cobot companies right now is on making their products suitable for new application scenarios. Currently, we are seeing a strong uptake in collaborative robot usage within the medical, education, logistics and catering fields. Moving forward, it is likely that we will see greater uptake within the industrial manufacturing industry where cobots are helping to plug the gaps caused by ongoing labor shortages.

Maya Xiao, Senior Analyst at Interact Analysis comments, “As we emerge from the COVID-19 pandemic, the issue of labor shortages is seemingly never ending. This is leading many to invest in collaborative robots. Our research shows that once one competitor invests in collaborative robots, and it is seen to work, there is a ripple effect. In 2021, global cobot shipments achieved a phenomenal year-on-year increase of 44.6%. Collaborative robots are being used as a form of ‘future-proofing’ because the pandemic creates so much uncertainty that companies don’t know what to expect next. Annually, we predict a 20-30% growth rate for the market, right out to 2026.”

About the Report:

Collaborative robots are an important part of intelligent manufacturing and an effective complement to lean production. They’ve enjoyed a spike in popularity over the past few years, benefitting from the push towards automation in industry and constant downward pressure on costs. But which industries will drive growth for collaborative robots in the next five years? What will be the pricing trends as volumes rise? How will collaborative robots complement or influence the traditional industrial robot market? What is the potential for collaborative robots in non-manufacturing fields?

This report answers these and other key questions facing the industry today.

➡ DOWNLOAD REPORT: https://www.interactanalysis.com/collaborative-robots-apr-2022/

![Forecasts, Opportunities, and Challenges for the Polish Industry in 2024 [ANALYSIS] Forecasts, Opportunities, and Challenges for the Polish Industry in 2024 [ANALYSIS]](https://industryinsider.eu/wp-content/uploads/xIndustry-40-320x167.jpg.pagespeed.ic.o8zijDQlIJ.jpg)

![The importance of artificial intelligence in transport and automotive industry is growing [REPORT] The importance of artificial intelligence in transport and automotive industry is growing [REPORT]](https://industryinsider.eu/wp-content/uploads/xcity-320x167.jpeg.pagespeed.ic.xFkQdk7qXO.jpg)

![By 2030, the market size of metal processing tools is expected to reach $120.44 billion [REPORT] By 2030, the market size of metal processing tools is expected to reach $120.44 billion [REPORT]](https://industryinsider.eu/wp-content/uploads/xcutting-tools-320x167.jpg.pagespeed.ic.SgnEk-RWA-.jpg)

![Methane emissions remains elusive challenge for oil and gas industry [REPORT] Methane emissions remains elusive challenge for oil and gas industry [REPORT]](https://industryinsider.eu/wp-content/uploads/xMethane-emissions-by-source-320x167.jpg.pagespeed.ic.q-7jG2luXb.jpg)

![Will digital twin revolutionize the aerospace and defense sector? [REPORT] Will digital twin revolutionize the aerospace and defense sector? [REPORT]](https://industryinsider.eu/wp-content/uploads/xdigital-twin-in-aerospace-320x167.jpg.pagespeed.ic.K-YNPhggcS.jpg)