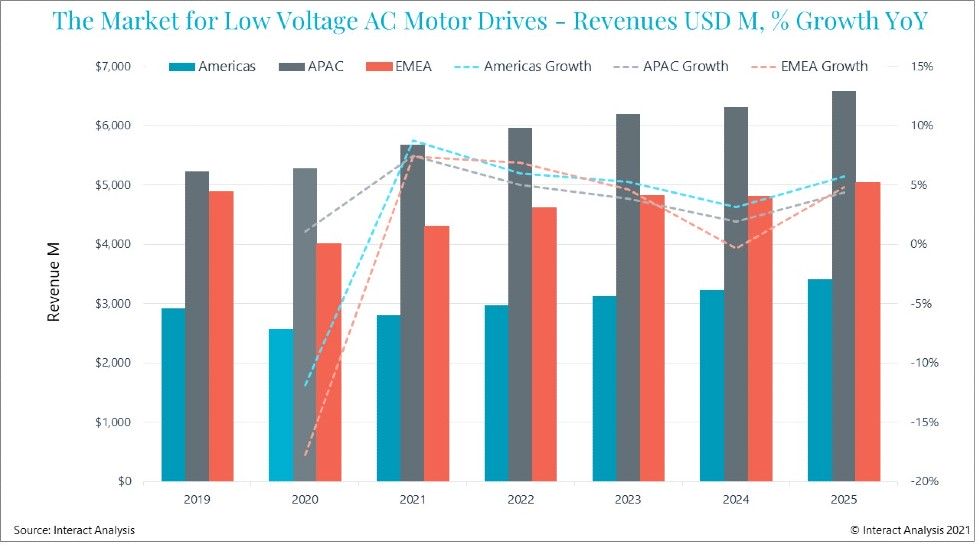

New research from global market intelligence firm Interact Analysis shows that, despite suffering a steep decline in 2020, the low voltage motor drives market is set to grow 7.7% in 2021. Growth is then expected to continue right out to 2025. The research also shows that drive unit prices are predicted to increase in 2021 as a result of component shortages.

As with most industries, the COVID-19 pandemic caused a sharp decline in the low voltage drives market, with a fall of -8.9% in revenues. The research shows that EMEA suffered the greatest decline of -17.8%, with the Americas following closely behind at -11.9%. The APAC region bucked the trend with market growth of 1.1% – primarily a result of strong growth in the Chinese economy during 2020.

As the world slowly recovers from the pandemic, the resurgence in demand has led to operational challenges for drives manufacturers and their customers. Supply issues are a problem for a range of key drive components, particularly semiconductors, and these will not be resolved until late 2022 or early 2023. Inflated shipping costs are also severely impacting profits. Overall, however, a general recovery from the pandemic is set to extend evenly across 2022 and 2023.

According to reports from vendors, drives orders increased significantly during the first half of 2021, with some companies reporting increases of 20 to 30% in order volumes. And many of these orders are due for delivery in the second half, suggesting that there is a high rate of stockpiling in the market. However, this is expected to level out across the course of the year. Global revenues are set to finally exceed pre-pandemic levels by 2022, with a CAGR of 4.8% globally between 2020 and 2025.

Blake Griffin, Senior Analyst at Interact Analysis says: “APAC was the only region to experience a period of growth during 2020. That’s because China was able to re-open and bounce back quickly after government imposed lockdowns. As a result of this, companies embedded in the APAC region, such as ABB and Fuji, were able to gain global market share. One exception was Siemens who, despite being a prominent vendor in APAC, still lost 0.5% of their overall global market share due to the collapse of manufacturing in Germany.”

About the Report:

In this 4th edition of our market report on low voltage AC motor drives we provide detailed market size and forecast data for low voltage AC motor drives by form, industry, application, country and power rating. In this new addition we have extended our regional segmentation to include Argentina, Indonesia, Thailand and Vietnam and increased our end user industry analysis to include airports, seaports & terminals as well as warehouses and commercial buildings.

![Forecasts, Opportunities, and Challenges for the Polish Industry in 2024 [ANALYSIS] Forecasts, Opportunities, and Challenges for the Polish Industry in 2024 [ANALYSIS]](https://industryinsider.eu/wp-content/uploads/xIndustry-40-320x167.jpg.pagespeed.ic.o8zijDQlIJ.jpg)

![The importance of artificial intelligence in transport and automotive industry is growing [REPORT] The importance of artificial intelligence in transport and automotive industry is growing [REPORT]](https://industryinsider.eu/wp-content/uploads/xcity-320x167.jpeg.pagespeed.ic.xFkQdk7qXO.jpg)

![By 2030, the market size of metal processing tools is expected to reach $120.44 billion [REPORT] By 2030, the market size of metal processing tools is expected to reach $120.44 billion [REPORT]](https://industryinsider.eu/wp-content/uploads/xcutting-tools-320x167.jpg.pagespeed.ic.SgnEk-RWA-.jpg)

![Methane emissions remains elusive challenge for oil and gas industry [REPORT] Methane emissions remains elusive challenge for oil and gas industry [REPORT]](https://industryinsider.eu/wp-content/uploads/xMethane-emissions-by-source-320x167.jpg.pagespeed.ic.q-7jG2luXb.jpg)

![Will digital twin revolutionize the aerospace and defense sector? [REPORT] Will digital twin revolutionize the aerospace and defense sector? [REPORT]](https://industryinsider.eu/wp-content/uploads/xdigital-twin-in-aerospace-320x167.jpg.pagespeed.ic.K-YNPhggcS.jpg)