Although the automotive market is responsible for only about 10% of the global demand for semiconductors, it is estimated that the industry may suffer up to 80% of the total losses caused by problems with their availability.

With the outbreak of the COVID-19 pandemic, car manufacturers were forced to halt production. Then, as the global economy slackened and demand for new cars plunged unprecedentedly, most car makers canceled their semiconductor orders. This led to a decrease in demand for these car parts – in April 2020, the demand was 30% lower than in the previous year.

The orders canceled by the automotive industry were used by computer, smartphone and server manufacturers who increased their orders to meet the growing demand caused by the need to adapt to the new digital reality. The dynamic digitization caused by the pandemic has led to an increase in semiconductor sales

As auto production and sales began to increase in the second half of 2020, automotive semiconductor inventories were quickly depleted. By the time car makers were ready to recreate their canceled shipments, most of the semiconductors had been reallocated to other customers, putting them at the bottom of the line waiting for deliveries. The lack of available semiconductors had a negative impact on the assumed production goals of some automotive companies – says Mirosław Michna, Partner in the Tax Advisory Department, Leader of the team of consultants for the automotive industry at KPMG in Poland.

The problem with semiconductors will be felt in 2022

The crisis with the availability of semiconductors will continue in 2022. This means serious problems with keeping up with the growing demand for new vehicles. Estimates indicate that electric vehicles need twice as many semiconductors as conventionally driven vehicles. In addition, 4/5 autonomy vehicles need 8 to 10 times more semiconductors than zero autonomy vehicles.

Despite the key role that semiconductors play and will continue to play in new cars, automotive manufacturers do not make any significant purchasing commitments to semiconductor companies. They usually do not order them directly from producers, using intermediaries. At the same time, they do not have long-term business relationships with semiconductor manufacturers, which makes it impossible to ensure an adequate number of stocks that would allow the production of vehicles without the delays resulting from disrupting the global supply chain.

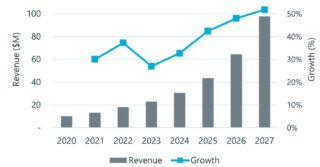

Automobile manufacturers’ purchases of semiconductors have grown exponentially over the past decade, with an estimated market value of $ 200 billion by 2040. However, despite this growth, automotive customers still account for less than 10 percent of total semiconductor sales. It is also worth noting that automotive manufacturers, along with the further development of technology used in vehicles, will increasingly compete for the supply of semiconductors with consumer electronics giants and telecommunications companies that buy much larger quantities – says Przemysław Szywacz, Partner in the Tax Advisory Department in the team of advisers for the automotive industry at KPMG in Poland.

This is not the first shortage the semiconductor sector has experienced. It will also not be the last. This shortage is largely due to a strong growth in demand, which will continue, driven by new applications not only in the automotive industry, but most importantly in other sectors of the economy. In order to minimize the risk of another problem with the availability of semiconductors, the production capacity should be increased. Political leaders around the world are now looking for ideas to end the semiconductor shortage and reduce the economic losses resulting from their shortage. The European Union, citing the need for “digital sovereignty”, has set itself the goal of doubling the production of semiconductors on its territory. If these plans are successful, the EU will be responsible for 20% of the world’s semiconductor production. The resources needed to finance the necessary investments are to come from funds earmarked for the recovery of the economies of the Member States affected by the pandemic.

About the report

KPMG publication entitled “Surviving the silicon storm” deals with problems arising from the shortage of semiconductors on the market. The publication focuses primarily on the automotive industry, which has suffered the most due to the lack of semiconductors, which are a key element of new car equipment.

![Forecasts, Opportunities, and Challenges for the Polish Industry in 2024 [ANALYSIS] Forecasts, Opportunities, and Challenges for the Polish Industry in 2024 [ANALYSIS]](https://industryinsider.eu/wp-content/uploads/xIndustry-40-320x167.jpg.pagespeed.ic.o8zijDQlIJ.jpg)

![The importance of artificial intelligence in transport and automotive industry is growing [REPORT] The importance of artificial intelligence in transport and automotive industry is growing [REPORT]](https://industryinsider.eu/wp-content/uploads/xcity-320x167.jpeg.pagespeed.ic.xFkQdk7qXO.jpg)

![By 2030, the market size of metal processing tools is expected to reach $120.44 billion [REPORT] By 2030, the market size of metal processing tools is expected to reach $120.44 billion [REPORT]](https://industryinsider.eu/wp-content/uploads/xcutting-tools-320x167.jpg.pagespeed.ic.SgnEk-RWA-.jpg)

![Methane emissions remains elusive challenge for oil and gas industry [REPORT] Methane emissions remains elusive challenge for oil and gas industry [REPORT]](https://industryinsider.eu/wp-content/uploads/xMethane-emissions-by-source-320x167.jpg.pagespeed.ic.q-7jG2luXb.jpg)

![Will digital twin revolutionize the aerospace and defense sector? [REPORT] Will digital twin revolutionize the aerospace and defense sector? [REPORT]](https://industryinsider.eu/wp-content/uploads/xdigital-twin-in-aerospace-320x167.jpg.pagespeed.ic.K-YNPhggcS.jpg)