New research from global market intelligence firm Interact Analysis shows that the market for industrial robot components will enjoy strong double digit growth in 2021, marking a clear turnaround after two years of disruption. However, 2021 market growth in revenue terms can be partially explained by major price increases in key components and raw materials, as well as supply chain issues and general inflationary pressure.

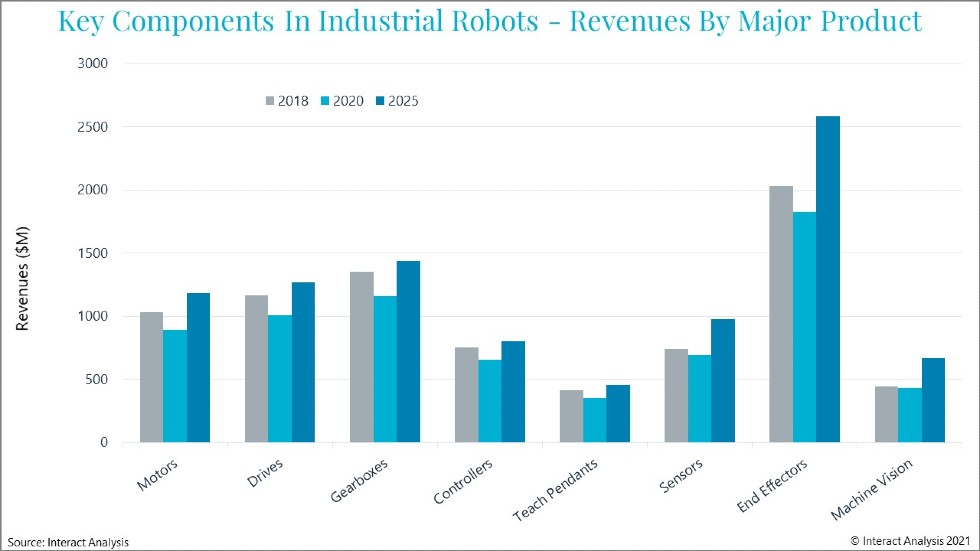

The key components markets covered by the report – motors, drives, gearboxes, controllers, teach pendants, sensors, end effectors, and machine vision – are all forecast for growth of varying degrees. Machine vision and end effectors will see the strongest performance as a result of particularly strong growth in the complex robotics systems that require these components. End effectors, which is the largest individual component market, will enjoy above average growth right out to 2025, by which time the sector will be worth more than $2.5 billion. Meanwhile, the combined market for motors, drives, and gearboxes will exceed that of end effectors, although a high proportion of these components are manufactured in-house by robot manufacturers themselves.

Machine vision was the only sector to remain stable throughout the pandemic, as impressive demand for this technology outweighed wider problems in the market and the supply chain. All other component sectors suffered market decline in 2019 and 2020. This was the knock-on effect of a severe decline in the wider industrial robot market caused by weak consumer demand for automotive and electronic products, and a difficult market for machine builders; followed by the impact of COVID-19.

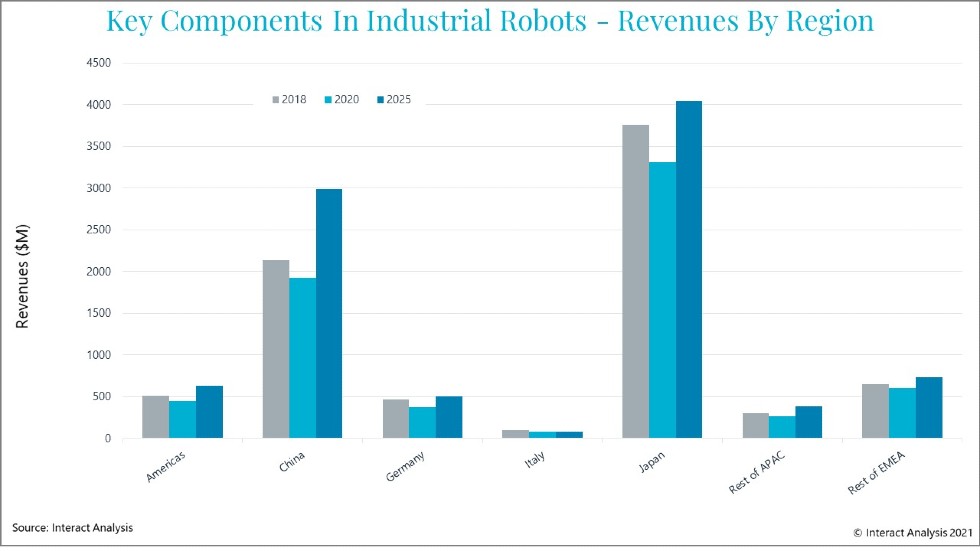

Industrial robot components is a market dominated by Japan, with China close behind. And, compared with these two countries, the market opportunity for robot components in the rest of the world is small. China will exceed Japanese unit production levels of industrial robots by 2022. However, revenues for industrial robot components will remain larger in Japan right out to 2025 – the end of the forecast period in the research, partly because Japan will remain the largest producer of higher payload (and therefore more expensive) articulated robots.

“Although the total market for key components used in articulated robots suffered the most between 2018 & 2020, mainly because of the automotive slowdown, component revenues in this sub-sector of robotics remained the largest by a significant margin. However, the articulated robot component market is dominated by well-entrenched vendors” says Tim Dawson, Senior Research Director at Interact Analysis. “In contrast, the collaborative robot component market is much more open to new entrants and is also growing strongly. Collaborative robot component revenues will exceed $1.1 billion by 2025.”

About the Report:

The industrial robot industry is lacking credible and detailed component market data. If you need to get accurate and up-to-date information on the opportunities associated with components used in industrial and collaborative robots (such as motors, gearboxes, controllers, end effectors, sensors, machine vision and other hardware components), then this report is the answer.

The report provides insight and in-depth analysis into the automation components used in industrial robots. And it complements our current understanding of the industrial and collaborative robot markets, providing robot vendors and automation suppliers with the deepest possible insight into the development of the automation used in each robot type.

![Forecasts, Opportunities, and Challenges for the Polish Industry in 2024 [ANALYSIS] Forecasts, Opportunities, and Challenges for the Polish Industry in 2024 [ANALYSIS]](https://industryinsider.eu/wp-content/uploads/xIndustry-40-320x167.jpg.pagespeed.ic.o8zijDQlIJ.jpg)

![The importance of artificial intelligence in transport and automotive industry is growing [REPORT] The importance of artificial intelligence in transport and automotive industry is growing [REPORT]](https://industryinsider.eu/wp-content/uploads/xcity-320x167.jpeg.pagespeed.ic.xFkQdk7qXO.jpg)

![By 2030, the market size of metal processing tools is expected to reach $120.44 billion [REPORT] By 2030, the market size of metal processing tools is expected to reach $120.44 billion [REPORT]](https://industryinsider.eu/wp-content/uploads/xcutting-tools-320x167.jpg.pagespeed.ic.SgnEk-RWA-.jpg)

![Methane emissions remains elusive challenge for oil and gas industry [REPORT] Methane emissions remains elusive challenge for oil and gas industry [REPORT]](https://industryinsider.eu/wp-content/uploads/xMethane-emissions-by-source-320x167.jpg.pagespeed.ic.q-7jG2luXb.jpg)

![Will digital twin revolutionize the aerospace and defense sector? [REPORT] Will digital twin revolutionize the aerospace and defense sector? [REPORT]](https://industryinsider.eu/wp-content/uploads/xdigital-twin-in-aerospace-320x167.jpg.pagespeed.ic.K-YNPhggcS.jpg)