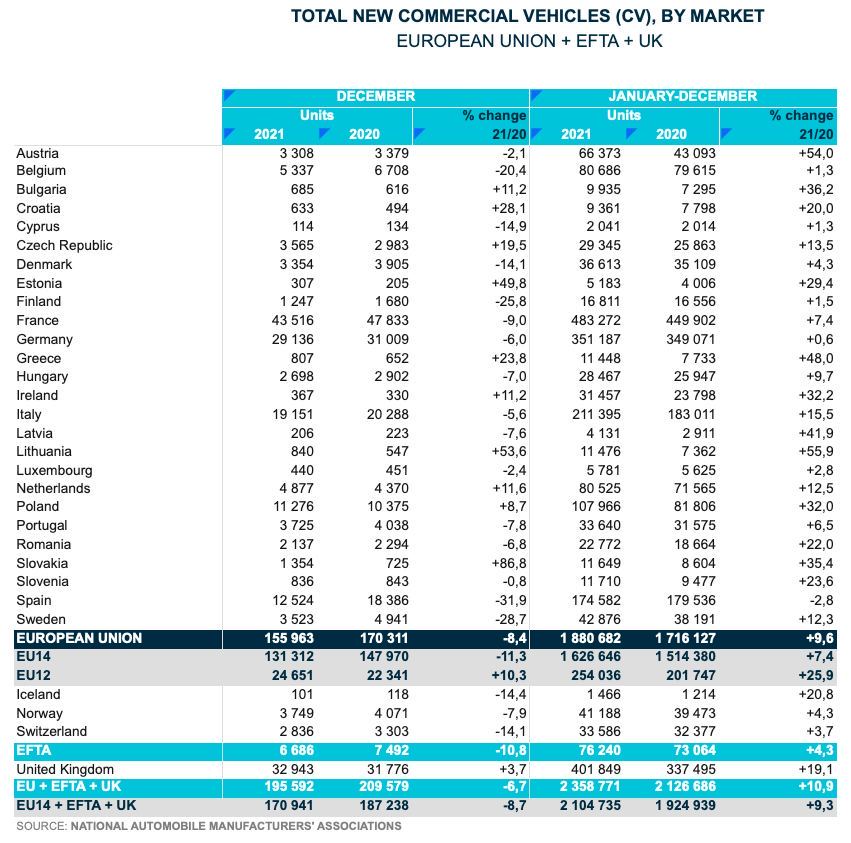

NEW COMMERCIAL VEHICLE REGISTRATIONS, EUROPEAN UNION[1]

In December, the EU commercial vehicle market contracted again, marking the sixth consecutive month of decline. Demand fell by 8.4% to 155,963 units, mainly due to a drop in new van sales. In fact, registrations of trucks and buses actually improved compared to December 2020. The region’s four major markets all posted drops, with the sharpest seen in Spain (-31.9%).

Overall in 2021, commercial vehicle registrations in the European Union increased by 9.6% to reach 1,880,682 units, largely thanks to the low base recorded during the first half of 2020. Nevertheless, this full-year result remains far below the 2.1 million units registered in 2019, the year before the pandemic. With the exception of Spain (-2.8%), all major EU markets posted growth last year. Italy saw the highest percentage gain (+15.5%) followed by France (+7.8%), while registrations increased by only a modest 0.6% in Germany.

NEW LIGHT COMMERCIAL VEHICLES (LCV) UP TO 3.5T[2]

During the month of December, registrations of new vans across the EU declined significantly (-12.8%) again. The main reason still being the microchip shortage that has hit production of this vehicle category in particular. This trend was reflected in the performance of the region’s four key markets, all posting strong declines in the last month of the year: Spain (-34.8%), Germany (-12.4%), France (-10.5%) and Italy (-9.2%).

Looking at full-year 2021 volumes, nearly 1.6 million light commercial vehicles were registered across the EU, a year-on-year rise of 8.5%, despite negative results in the last six months of the year. However, performances were mixed in the four big markets. In Spain (-4.0%) and Germany (-0.8%) new van registrations fell slightly, while Italy and France ended the year positively, with volumes up by 14.7% and 7.5% respectively.

NEW HEAVY COMMERCIAL VEHICLES (HCV) OF 16T AND OVER[3]

In December, demand for new heavy commercial vehicles in the European Union saw solid growth (+23.5%). This was largely driven by Central Europe’s strong performance, and Poland (+69.4%) especially. The four largest markets in Western Europe also contributed positively to last month’s growth, in particular Germany (+18.0%) and Spain (+15.7).

In 2021, new heavy truck registrations surged by 21.2%, totalling 240,346 units across the European Union. However, this is still around 12% below 2019 pre-pandemic levels. All 27 EU markets posted growth last year, including the four largest ones: Italy (+24.5%), Spain (+12.5%), Germany (+10.4%) and France (+5.6%).

NEW MEDIUM AND HEAVY COMMERCIAL VEHICLES (MHCV) OVER 3.5T[4]

In December 2021, 25,314 new medium and heavy trucks were sold in the EU, up 19.1% compared to the same month one year before. Similar to the heavy truck segment, Central Europe, and Poland (+59.3%) in particular, gave a significant boost to this growth. Looking at the four major markets, Italy (+21.2%) and Germany (+14.6%) recorded the strongest gains, followed by Spain (+2.2%), while demand remained stable in France (-0.2%).

Last year, new truck registrations across EU expanded by 16.8% to reach 289,316 units sold in total. Despite negative results from September to November, gains recorded during the first half of the year and in December helped the full-year performance. As a result, nearly all EU markets managed to perform better than in 2020, including the four major ones: Italy (+22.3%), Spain (+8.1%), Germany (+5.6%) and France (+5.5%).

NEW MEDIUM AND HEAVY BUSES & COACHES (MHBC) OVER 3.5T

In December, 3,855 new buses and coaches were registered across the European Union, a gain of 6.8% compared to December 2020. Double-digit increases were recorded in three of the region’s four key markets: Italy (+40.7%), France (+38.7%) and Germany (+26.6%). By contrast, Spain suffered a significant decline (-36.4%) during the last month of the year. Overall in 2021, EU demand for buses and coaches increased by a modest 2.8% to 29,941 units sold. Among the region’s largest markets, only Spain saw a decline (-10.2%), while bus registrations remained almost unchanged in Germany compared to 2020 (+0.2%). France (+13.4%) and Italy (+11.1%) ended the year on a positive note, both recording double-digit gains.

![Forecasts, Opportunities, and Challenges for the Polish Industry in 2024 [ANALYSIS] Forecasts, Opportunities, and Challenges for the Polish Industry in 2024 [ANALYSIS]](https://industryinsider.eu/wp-content/uploads/xIndustry-40-320x167.jpg.pagespeed.ic.o8zijDQlIJ.jpg)

![The importance of artificial intelligence in transport and automotive industry is growing [REPORT] The importance of artificial intelligence in transport and automotive industry is growing [REPORT]](https://industryinsider.eu/wp-content/uploads/xcity-320x167.jpeg.pagespeed.ic.xFkQdk7qXO.jpg)

![By 2030, the market size of metal processing tools is expected to reach $120.44 billion [REPORT] By 2030, the market size of metal processing tools is expected to reach $120.44 billion [REPORT]](https://industryinsider.eu/wp-content/uploads/xcutting-tools-320x167.jpg.pagespeed.ic.SgnEk-RWA-.jpg)

![Methane emissions remains elusive challenge for oil and gas industry [REPORT] Methane emissions remains elusive challenge for oil and gas industry [REPORT]](https://industryinsider.eu/wp-content/uploads/xMethane-emissions-by-source-320x167.jpg.pagespeed.ic.q-7jG2luXb.jpg)

![Will digital twin revolutionize the aerospace and defense sector? [REPORT] Will digital twin revolutionize the aerospace and defense sector? [REPORT]](https://industryinsider.eu/wp-content/uploads/xdigital-twin-in-aerospace-320x167.jpg.pagespeed.ic.K-YNPhggcS.jpg)